Die Financial Services Industrie hat in den letzten Jahren eindrucksvoll bewiesen, wie sich eine klassische Branche mit PPM sukzessive digitalisieren kann. Lesen Sie in diesem Beitrag:

- Welche Herausforderungen Finanzdienstleister bewältigen müssen

- Wie das moderne Methodenset im Projektmanagement von Finanzinstituten aussieht

- Warum sich bei digitalen Vorreitern der Einsatz von PPM-Lösungen bereits bewährt hat

- Was eine erfolgreiche PPM-Einführung ausmacht

- Wann Banken und Finanzdienstleistungsunternehmen eine PPM-Software implementieren sollten

Financial Services: Eine Branche im Umbruch

Der Finanzsektor steckt mitten in der digitalen Transformation: Stationäre Bankfilialen spielen in der Omnichannel-Strategie der Banken eine zunehmend untergeordnete Rolle. Konsumenten fordern 24/7 Self-Services und sind bereit, neuen, nicht etablierten Marktteilnehmern eine Chance zu geben. Technologie-Giganten launchen innovative Finanzprodukte und setzen mit ihrer Digitalexpertise die Branche unter Druck. Gleichzeitig steigt die Zahl der Regularien und die Bedrohung durch Cyberrisiken.

Digitalisierungsmanagement ist demnach eine unternehmensübergreifende Verantwortung, die neue Formen des Multiprojektmanagements erfordert.

PPM-Methoden und Lösungen bei führenden Financial Services-Anbietern

Trotz oder gerade wegen der disruptiven Marktkräfte steht die Finanzbranche mittlerweile an der Spitze diverser Digitalisierungsrankings. Ein zentraler Erfolgsfaktor für diesen enormen Fortschritt liegt in der jahrzehntelangen Erfahrung mit unterschiedlichen Projektmanagementmethoden und -standards. ITIL und Prince2 sind in der Finanzbranche weit verbreitet und zuletzt vermehrt durch agile Ansätze wie Scrum und SAFe ergänzt beziehungsweise ersetzt worden.

Die digitalen Champions der Branche sind längst dazu übergegangen, ihre Projektmanagementorganisation digital zu managen. Dabei haben sich PPM-Lösungen als ideales Abbild führender Projektmanagementmethoden herausgestellt.

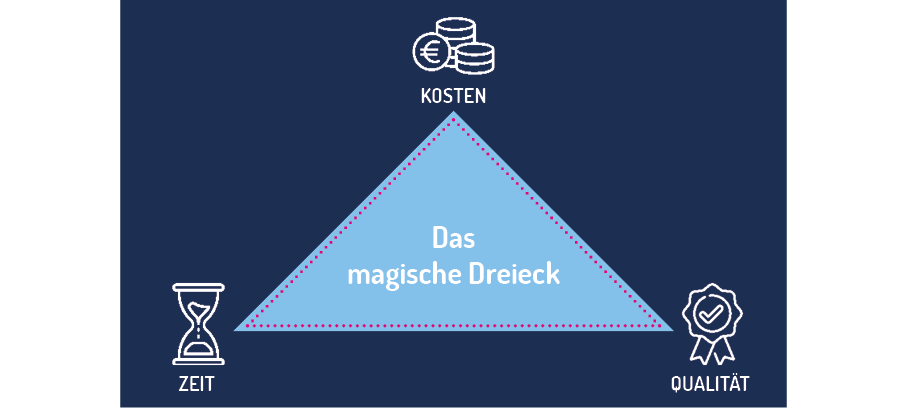

Das magische Dreieck des Projektmanagements als traditionelle Konstante

Unabhängig von der aktuellen Projektmanagementphilosophie steht stets das magische Dreieck des Projektmanagements mit den Faktoren Kosten, Zeit und Qualität im Fokus der Finanzorganisationen.

Im dynamischen Marktumfeld gilt es aber zunächst, ausgewählte Projekte zu priorisieren, wofür PPM-Lösungen im Financial Services-Bereich das passende Methodenset bieten. In einem agilen Unternehmenssetting bedeutet das mitunter auch, dass bereits laufende Projekte regelmäßig neu evaluiert und je nach Analyse “on hold” oder im Ausnahmefall sogar ganz eingestellt werden müssen. Diese vermeintlichen Projektrückschläge gilt es der Triangulierung entsprechend zu berücksichtigen.

10 Vorteile einer PPM-Einführung im Financial Services Bereich

Richtige Entscheidungen zur digitalen Transformation sind nur schwer anhand einfacher Schemata zu treffen oder zu legitimieren. Durch die Nutzung branchenspezifischer PPM-Software kann diese aber nachvollziehbar und effizient gemanagt werden.

PPM kann für Financial Services:

- Strategische Organisationsziele abbilden, mit einzelnen Projekten verknüpfen und durch KPIs sinnvoll tracken

- Projekte, aber auch einzelne Projekttätigkeiten anhand klar definierter Kriterien priorisieren

- Eine Balance zwischen kurz-, mittel- und langfristigen Projektzielen für höchste Projekteffektivität herstellen

- Unterschiedlichen Organisationseinheiten einen aussagekräftigen Überblick zu Projekten entlang der diversen Projektstadien bieten

- Kosten- und Projektpläne dynamisch und projektübergreifend anpassen

- Kapazitätsauslastungen vorausschauend berücksichtigen

- Szenariorechnungen in unterschiedlichen Komplexitätsstufen durchführen

- Projektkommunikation abseits von E-Mails transparent abhandeln

- Relevante Projekterfahrungen für die organisationale Lernkurve dokumentieren

- Compliance-Vorgaben zur Projektorganisation automatisch erfüllen

Mit einer PPM-Lösung haben Financial Services-Anbieter für die Planung und Abwicklung ihrer digitalen Projekte ein leistungsstarkes Instrumentarium zur Verfügung. Top-down und Bottom-up-Ansätze können koexistieren und sich gegenseitig positiv beeinflussen.

Capture Praxis-Tipp: Grüne-Wiese- oder Braune-Wiese-Ansatz im Projektmanagement

Auch wenn PPM-Software von Entscheidungsträgern und Praktikern als State of the Art erkannt wird, ist damit eine zeitnahe Implementierung noch nicht gesichert. Viele Finanzunternehmen haben für ihre Projektmanagementaufgaben bereits diverse Einzellösungen im Einsatz und scheuen den Modernisierungsaufwand rund um ihre Projektmanagementorganisation.

Auch hier ist eine Lösung möglich: PPM deckt zwar den gesamten Projektmanagement-Lebenszyklus ab, es können aber auch nur einzelne Module genutzt werden. Starten Sie mit PPM-Bereichen, die in Ihrer Organisation noch nicht abgedeckt sind oder im operativen Betrieb nicht die gewünschte Wirkung zeigen.

Ob Demand Management, Resource Management oder Financial Management - mit Projektportfoliomanagement ist die digitale Transformation Ihrer Financial Services Organisation optimal aufgegleist.

Gratis PPM Erstberatung für Financial Service-Anbieter

Unsere Consultants freuen sich, Ihnen im Rahmen einer Live-Demo die Möglichkeiten einer PPM-Implementierung zu zeigen.