Merry Christmas and Happy New Year!

Frohe Weihnachten und ein glückliches Neues Jahr

Kellemes Karácsonyt és boldog új évet!

GO TO CAPTURE.EU

In recent years, the financial services industry has impressively demonstrated how a traditional industry can gradually digitize itself with PPM. Read in this article:

The financial sector is in the midst of digital transformation: stationary bank branches are playing an increasingly subordinate role in banks' omnichannel strategy. Consumers are demanding 24/7 self-services and are prepared to give new, non-established market players a chance. Technology giants are launching innovative financial products and putting pressure on the industry with their digital expertise. At the same time, the number of regulations and the threat of cyber risks are increasing.

Digitalization management is therefore a cross-company responsibility that requires new forms of multi-project management.

Despite, or perhaps because of, disruptive market forces, the financial industry is now at the top of various digitization rankings. A key success factor for this enormous progress lies in decades of experience with various project management methods and standards. ITIL and Prince2 are widely used in the financial sector and have recently been increasingly supplemented or replaced by agile approaches such as Scrum and SAFe.

The digital champions of the industry have long since moved to managing their project management organization digitally. In the process, PPM solutions have proven to be an ideal reflection of leading project management methods.

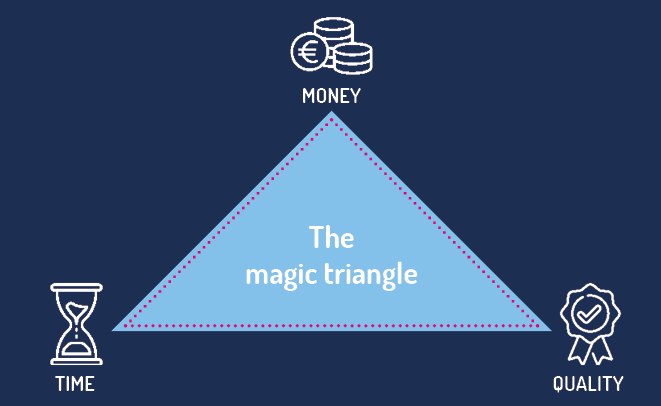

Regardless of the current project management philosophy, the focus of financial organizations is always on the magic triangle of project management with the factors of cost, time and quality.

In the dynamic market environment, however, selected projects must first be prioritized, for which PPM solutions in the financial services sector offer the appropriate set of methods. In an agile corporate setting, this sometimes means that projects that are already underway must be regularly re-evaluated and, depending on the analysis, put on hold or, in exceptional cases, even discontinued altogether. These supposed project setbacks must be taken into account accordingly in the triangulation.

Proper digital transformation decisions are difficult to make or legitimize based on simple schemas. However, by using industry-specific PPM software, this can be managed in a comprehensible and efficient manner.

Project portfolio management for financial services can:

With a PPM solution, financial services providers have a powerful set of tools for planning and managing their digital projects. Top-down and bottom-up approaches can coexist and positively influence each other.

Even if PPM software is recognized by decision-makers and practitioners as state of the art, this still does not ensure timely implementation. Many financial companies already use various individual solutions for their project management tasks and shy away from modernizing their project management organization.

Here, too, a solution is possible: PPM covers the entire project management lifecycle, but only individual modules can be used. Start with PPM areas that are not yet covered in your organization or are not having the desired effect in operations.

Whether demand management, resource management or financial management - with project portfolio management, the digital transformation of your organization is optimally prepared.

Free PPM Initial Consultation for Financial Service Providers

Our consultants will be happy to show you the possibilities of a PPM implementation during a live demo.

To access this document, please enter your email address.

If you want to view this webinar video, please enter your email address in the field below.

We have sent you an email to your email address with a link to the file.

OK